Jamaican athletes urged to be wise when investing money

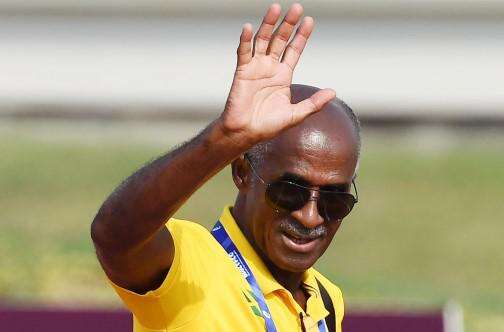

JAMAICA’S track and field icon Donald Quarrie is warning Jamaican athletes that they should employ people who are trustworthy to manage their financial affairs as they prepare for life after sports.

“Athletes need to be as careful in life…they have a limited amount of time in the sport to make good money and they should be diligent in making sound decisions to the best of their ability,” he said.

Quarrie won 200m gold and 100m silver at the Montreal Olympics in 1976 as well as a bronze in the 200m in Moscow in 1980. He is also a six-time Commonwealth Games gold medallist, winning the sprint double in 1970 and 1974 and the 100m in 1978.

Ryan Foster, CEO and secretary general of the Jamaica Olympic Association (JOA), said it is very unfortunate what is alleged to have happened to Bolt but, despite this, athletes should not stop investing their money. He said that they need to properly educate themselves as to what they are investing in and should ensure that they surround themselves with good financial advisors.

“One of the first things that I would say is that athletes should never stop investing, because the fact of the matter is that the athlete’s shelf life in most instances is different from a regular nine-to-five person being employed in a corporate entity, hence their investment now is their pension for later in life after they would have stopped competing on the field of play,” said Foster.

“My other advice to athletes now as well is to: ‘Do your due diligence in terms of how you invest and who you invest with, how much do you invest as well and where you invest — so the fundamentals of investments would have not changed,” he added.

In addition to doing their own research and investigation into financial properties they wish to put their money into, a qualified and reputable advisor should be part of that process.

“Most athletes will not have the necessary financial expertise in terms of where to invest in, how much to invest, and what type of denomination (in terms of currency) to invest in, and so in most instances I would advise athletes to get a personal financial advisor that would give them [help in] terms of how they invest and how much to invest for life after sports.

“That financial advisor must have the necessary competences in terms of how to advise them and in terms of their investment portfolio,” Foster said.

He pointed out that athletes must also take a very active role in their investment portfolios after they have invested their money so as to ensure that their investments are doing what they are supposed to do at all times.

“This will ensure that there is some sense of security in terms of what is happening with your investments because it is your pension and it is not the pension of a regular person, ” Foster said.

“It is unfortunate what would have happened to Usain in terms of what is being alleged now but don’t stop [investing] in terms of looking at action at how to invest because there is life after sports. The typical person would retire at 60 or 65 but most athletes do not compete beyond 35, and as such you have to now ensure that there is something in place for you after you would have competed in whatever discipline or sporting event that you participated in,” he ended.

FOSTER…do your due diligence in terms of how you invest and who you invest with (Photo: Observer file)

and then

and then